- BTC holders continue to see profits on their investments.

- This has remained despite tight price movements in the currency.

new a report By Glassnode found that Bitcoin [BTC] Holders of the coin continue to hold unrealized gains despite the leading coin’s tight moves in the past few weeks.

At press time, Bitcoin was trading at $65,625. Trending within a horizontal channel, the coin encountered resistance at $71,656 and found support at $64,825. However, despite the “sideways price movement,” “investor profitability in BTC remains strong.”

According to the on-chain data provider:

“BTC prices are consolidating within an established trading range. Investors remain generally positive, with over 87% of circulating supply holding profit, with a cost basis below the spot price.

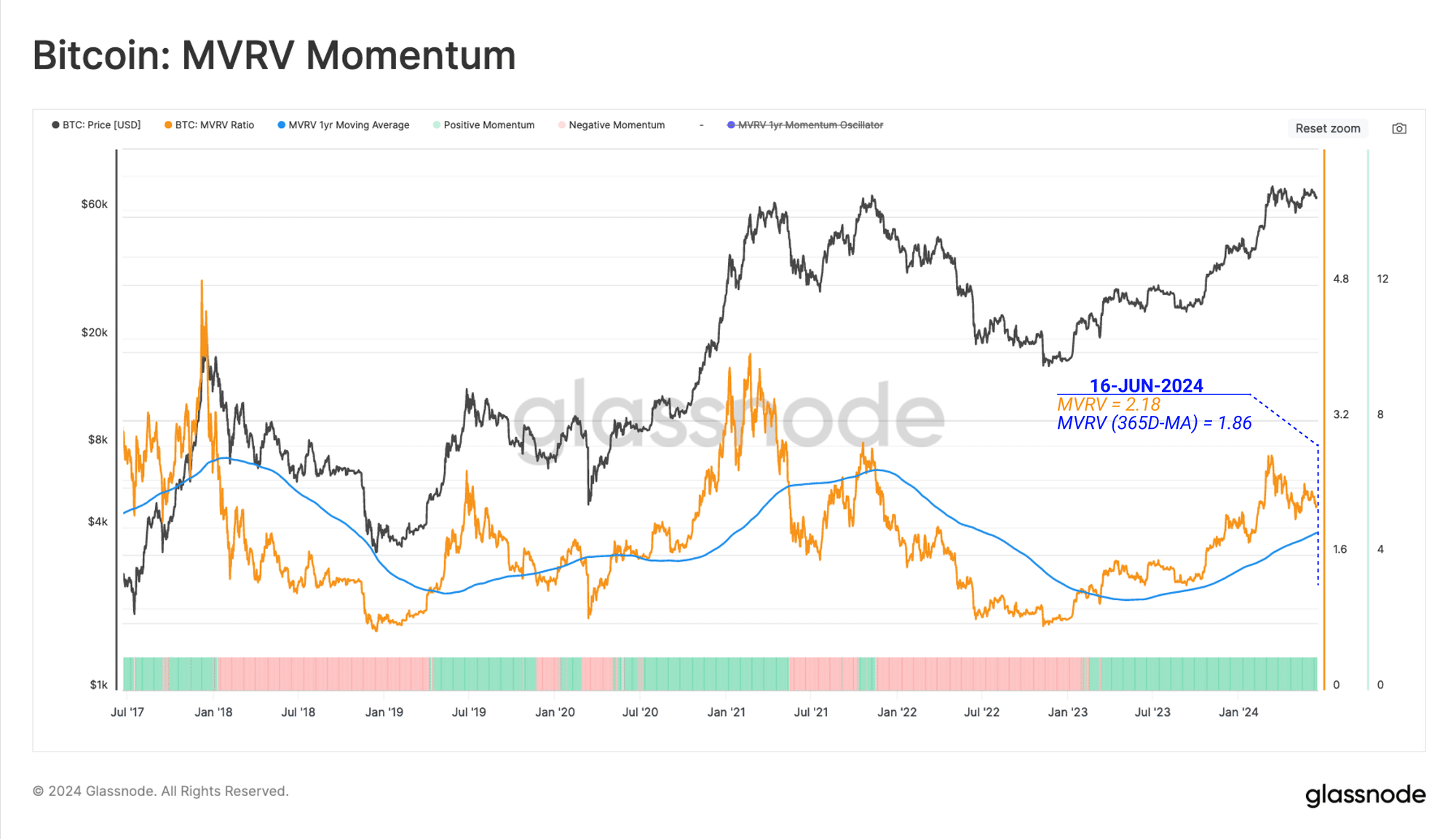

Glassnode evaluated the coin’s market capitalization to realized value (MVRV) ratio and found that the average BTC in circulation carries an unrealized gain of more than 120%.

Source: Glassnode

Interestingly, despite how profitable Bitcoin holders are, the volume of coins processed and transferred on the Bitcoin network since March’s all-time high (ATH) has declined significantly.

Glassnode noted that this decline “confirms the decreased appetite for speculation and increased hesitation in the market.”

Low exchange activity

BTC price consolidation also led to a decline in BTC exchange flows. Glassnode found that BTC short-term holders (STHs) are currently sending approximately 17,400 BTC (worth $1.13 billion at current market prices) to exchanges daily.

These investors hold their coins for a relatively short period, typically less than 155 days.

The current exchange inflows represent a 68% decline from the 55,000 BTC sent to exchanges by this group of investors when the currency rose to an all-time high of $73,000 in March.

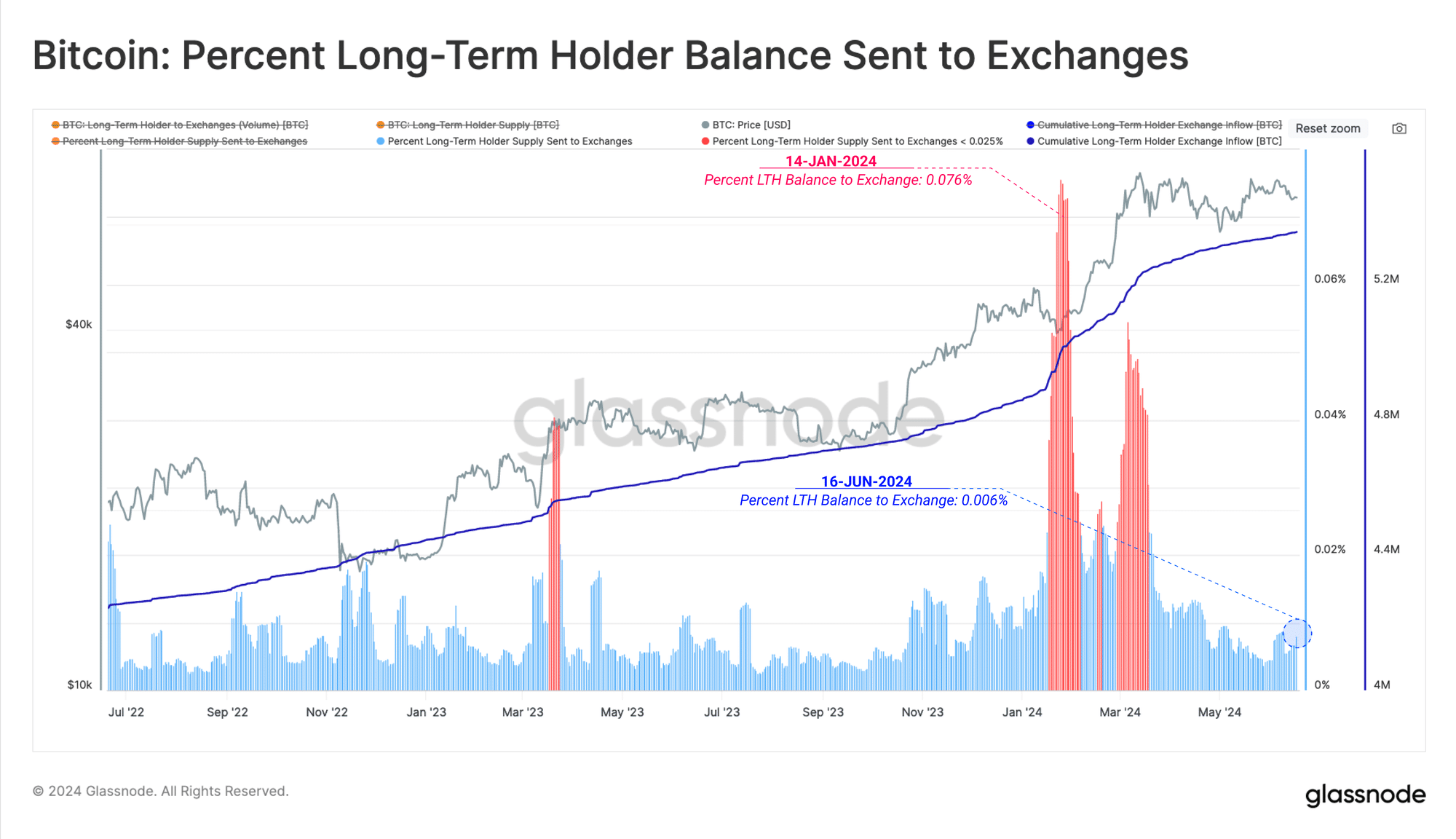

As for Long Term Holders (LTHs), “their distribution on exchanges is relatively low, with only marginal inflows of 1k+ BTC per day at the moment.”

Source: Glassnode

Glassnode said:

“LTHs send less than 0.006% of their total holdings to exchanges, indicating that this pool has reached equilibrium and that higher or lower prices are needed to stimulate more action.”

Read Bitcoin [BTC] Price forecasts 2024-25

The average BTC sent to exchanges makes a profit of about $5,500. This has prompted some investors who have held the stock for a long time to sell for a profit.

With the market anticipating a rise to $73,750 ATH, there is enough demand to absorb selling pressure. However, it is “not large enough to push market prices higher.”

“Infuriatingly humble alcohol fanatic. Unapologetic beer practitioner. Analyst.”