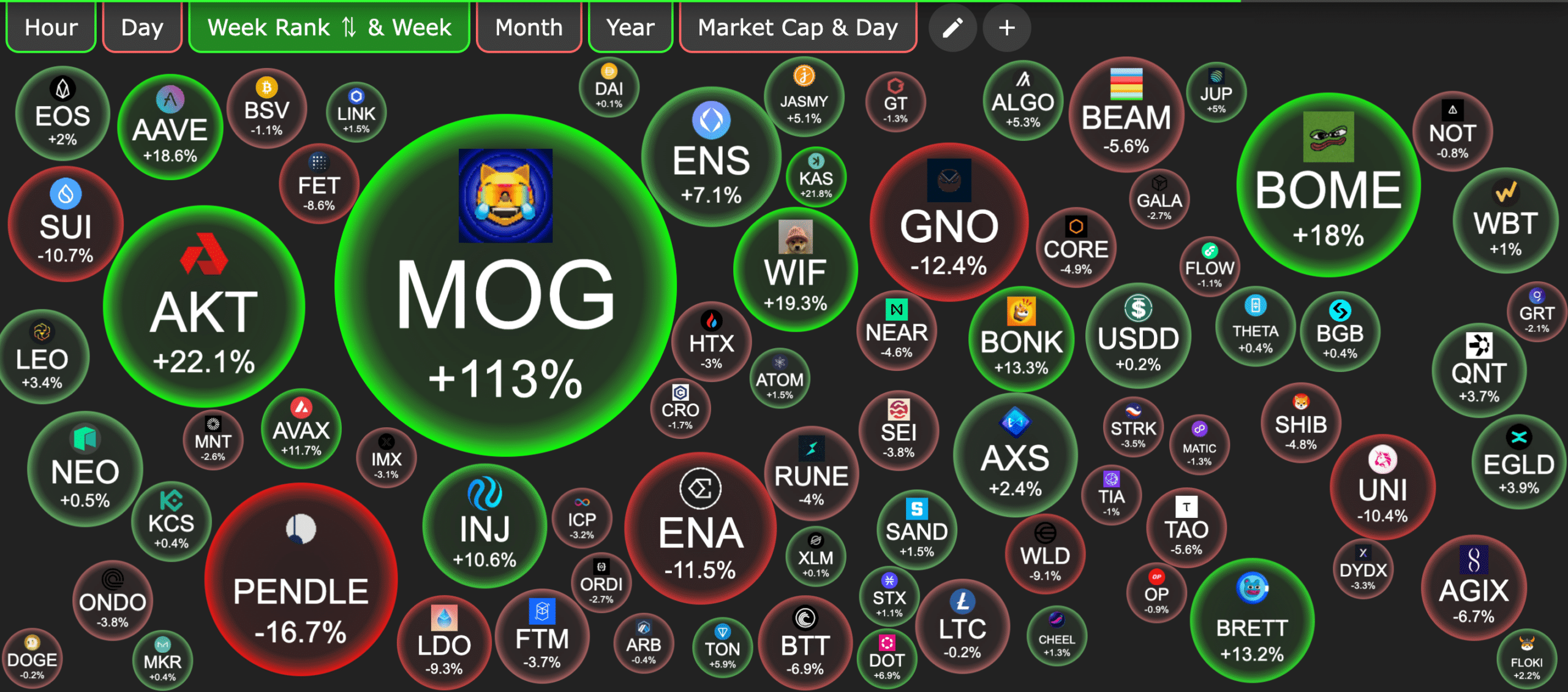

- Mog Coin has flipped BOME in terms of market cap, rising more than 100% in the past week.

- Technical indicators are pointing to potential overbought conditions for the current Mog Coin price spike.

Ethereum [ETH] com.memecoin Mog coin [MOG] It witnessed a noticeable increase in its value, as its price rose by 10.31% during the past 24 hours to $0.000001922for every Coin Market Cap.

The company’s market capitalization also rose by 8.92%, to $692.62 million, placing it at No. 97.

Despite this positive price movement, daily trading volume fell by 32.98% to $53.47 million. Hence, while investor confidence rose, trading activity declined, indicating potential consolidation.

Ethereum’s MOG flips Solana’s BOME

MOG Coin has recently been put up for sale on BOOK OF MEME [BOME] While it displayed an increase of more than 115% in the past week. This amazing performance pushed MOG to become one of the best performing meme coins.

Speculation is growing as to whether MOG will also overtake BONK, driven by renewed interest in Solana [SOL] Ecosystem and positive developments in the cryptocurrency ETF space.

Source: Crypto Bubbles

OSF, a personality in the cryptocurrency space, Comment MOG’s growth over the past year represents a well-executed memecoin strategy.

This community-driven momentum has been a crucial factor in MOG’s rapid rise in the market.

Likewise, Eddie, a cryptocurrency trader on X (formerly Twitter), Notice,

“$MOG is still going strong, getting a lot of mentions on the timeline and key friends like @kmoney_69 who are doubling down on token creation.”

he added,

“I opened a trade at this point, with a wide stop loss and looking for momentum to continue. I will close my trade if the market breaks down or the MOG chart shows weakness.”

Source: Eddie/X

Technical analysis and market indicators

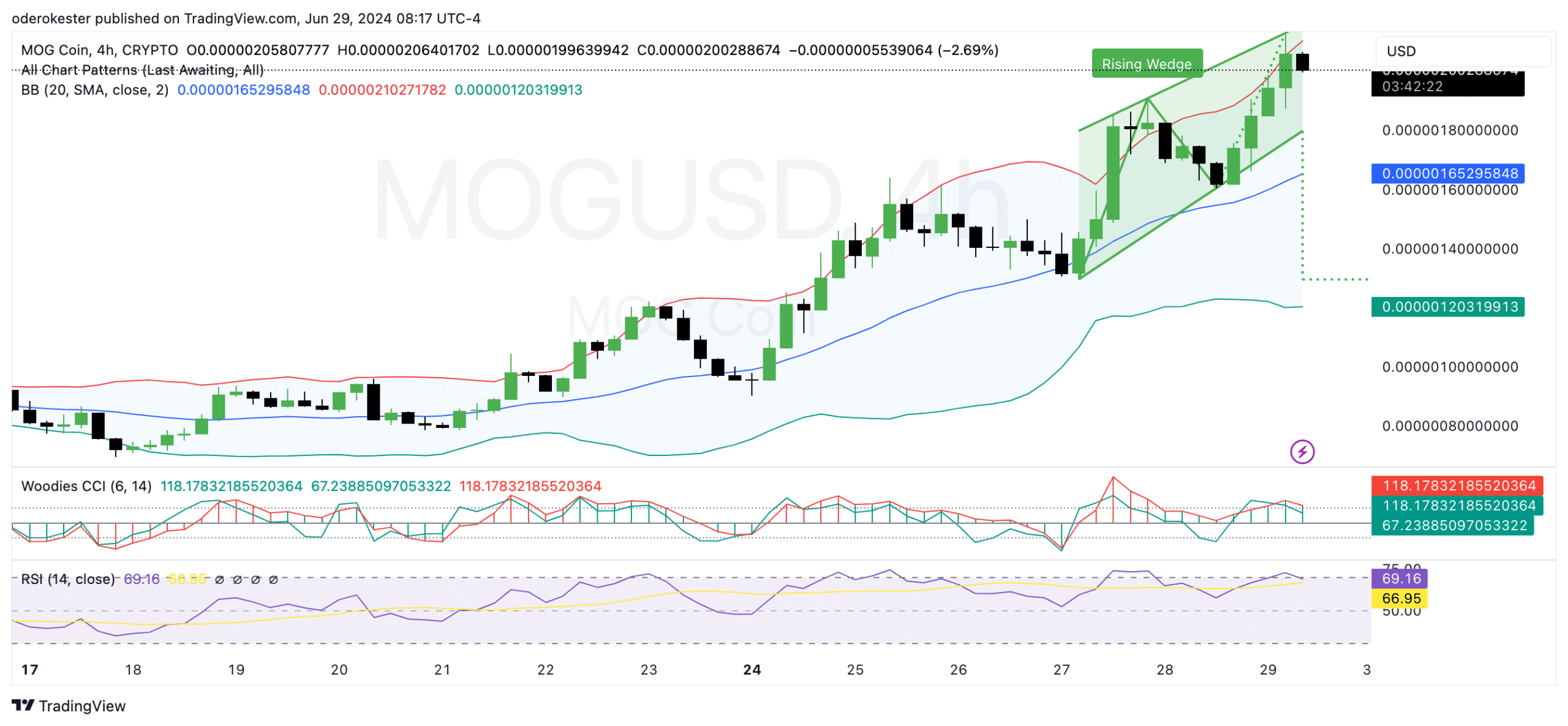

The Mog Coin price chart showed a rising wedge pattern at press time, indicating potential short-term bullish momentum.

The Bollinger bands indicated that MOG was experiencing volatility, with the price moving near the upper band, often indicating overbought conditions.

Current levels were well above the moving average, which reinforced the bullish sentiment.

At the time of writing, the Relative Strength Index (RSI) was at 70.10, entering the overbought zone, which could indicate a potential pullback or consolidation soon.

The Commodity Channel Index (CCI) was also in an elevated range at 114.29, suggesting that MOG may be overextended.

Traders should watch for any bearish divergence or breakout below the rising wedge pattern, which may indicate a reversal or correction.

Source: TradingView

according to IntoTheBlockMog Coin transaction statistics reveal an overall increase in both transaction volume and price from late February to early May 2024.

Read moog coins [MOG] Price forecast 2024-2025

The number of transactions peaked in late May, coinciding with the rise in prices, before beginning to decline in June.

This pattern indicated a period of increased activity and interest in the Ethereum-based memcoin, followed by a subsequent decline in market participation.

“Infuriatingly humble alcohol fanatic. Unapologetic beer practitioner. Analyst.”